Blog

Behind the design, into the mastermind.

Invest in Diamonds: Learn About the Opportunity

May 22, 2020

For many the purchase of diamonds is an emotional investment, often as a gift to a loved one or as an item of jewelry that will be lovingly passed on from one generation to another. For some, though, diamonds are also a financial investment, acquired with the hope that over time their value will increase. During times of instability in particular, investors often look for more tangible forms of wealth placement, and for several hundred years gold and diamonds have been perceived in this sense.

As a commodity, diamonds have a value that is dictated by the forces of market demand and supply. This is why, for example, lab-grown diamonds cannot be considered an investment, since they are easily produced and can be mass created. Natural diamonds, in contrast, are unique by nature and in limited supply. Intrinsic to measuring a diamond’s value are the 4 Cs, meaning the cut, clarity, color and carat. Each of these 4 Cs will determine the beauty, desirability and rarity of the stone, and in turn impact its value.

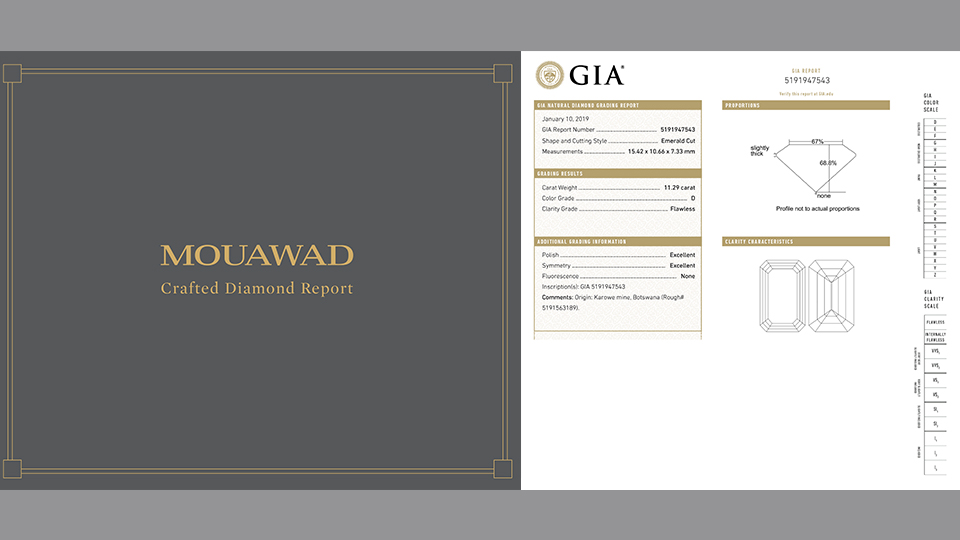

In addition to the 4 Cs, a fifth C, certification, is always advised when considering acquiring a diamond, whether for investment or for pleasure. At Mouawad, the issuing of a Mouawad Crafted Diamond Report provides clients with confidence in their acquisition, acting as a testament of the inherent expertise and artistry in crafting it, as well as tracing the diamond’s journey from sourcing through cutting and polishing, passing through stringent quality standards along the way.